Certificate in IFRS - ACCA

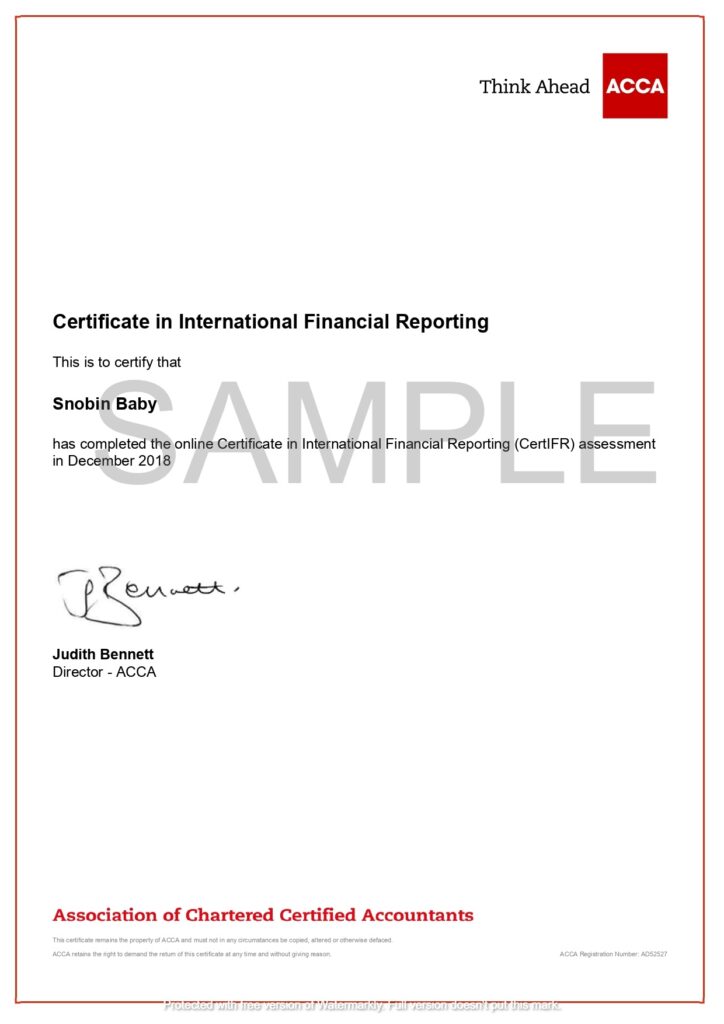

Certificate in International Financial Reporting Standards (ACCA)

Overview

This financial reporting course offers a broad introduction to the field of International Financial Reporting and International Financial Reporting Standards (IFRS). It traces the history of the International Accounting Standards Board (IASB) from its early roots through to recent changes and updates and future developments. The qualification is structured in an accessible and userfriendly way that underlines key information and provides useful summaries. It examines and breaks down specific standards topic-by-topic. There are case studies, which are based on real-life examples, and many exercises, multiple-choice questions and sample answers for you to test your knowledge as you progress through the course.

Course Objectives

- To help you understand how International Financial Reporting Standards (IFRS) are used around the world.

- To explain how the IFRS Foundation / International Accounting Standards Board work and how these are being changed.

- To examine the fundamental requirements of IFRS on a standard-by-standard basis.

- To provide guidance on how to use IFRS in practice.

WHO IS IT FOR?

WHO IS IT FOR? Our e-learning course is an introduction to International Financial Reporting Standards (IFRS). Nationally qualified accountants and auditors can now update their skills to meet the challenges involved in adopting and implementing IFRS in their workplace. An educational or vocational background in financial reporting is recommended before starting the CertIFR. This course also benefits ACCA members who gained their qualification prior to the introduction of IFRS. For ACCA members whose qualifications are already based on IFRS, the Cert IFR is an opportunity to update their IFRS knowledge for recent IASB publications.

HOW IT WORKS?

The online course includes all the study materials and learning resources you will need. You can apply CertIFR at any time. Students need to make payment and provide necessary documents in order to get access to the online course and assessments. This course has a validity of six months, so students who joined for the course will have to complete the course with in the time period for the certification. Typically, a student should take 20 hours to work through the course. Studying for another qualification as an ACCA member, can count towards your continuing professional development (CPD). The certificate is assessed by a one-hour exam with 25 multiple-choice questions with no negative marking.

The pass mark is 50%

The fees cover two attempts to re-sit the assessment if you fail but must be taken within six months of accessing the online course. If you do not pass after three attempts, you will need to pay another registration fee to attempt the assessment again, giving you a further three attempts to pass.

For more information Click Here

.png)